Advanced Financial Metrics: 512190676, 294755577, 919905905, 6944352150, 621623461, 4055786066

Advanced financial metrics, such as those represented by codes 512190676, 294755577, and 919905905, serve as critical tools for investors. These metrics provide deeper insights into market dynamics and risk assessment. They go beyond traditional ratios, offering a nuanced understanding of performance and potential. Stakeholders can leverage these advanced metrics for more strategic portfolio management. However, the implications of these data points necessitate further exploration into their practical applications and effectiveness in investment strategy.

Understanding the Basics of Financial Metrics

Although financial metrics can vary significantly between industries, they serve a fundamental purpose: to evaluate a company’s performance and financial health.

Key indicators such as financial ratios, profit margins, and cash flow reveal insights into a firm’s cost structure and revenue growth.

Additionally, assessing return on investment allows stakeholders to gauge efficiency, ultimately guiding strategic decisions and fostering a desire for financial freedom.

Analyzing Key Financial Indicators

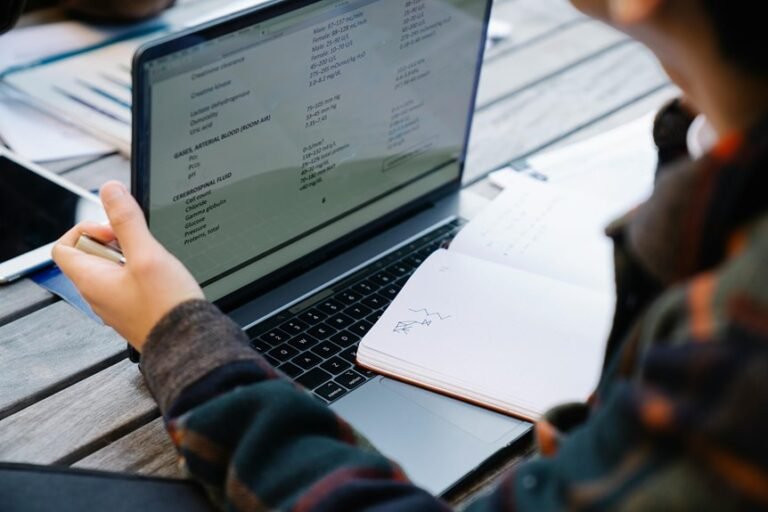

Building on the foundational understanding of financial metrics, analyzing key financial indicators enables stakeholders to extract deeper insights into a company’s operational efficiency and profitability.

The Role of Advanced Metrics in Investment Strategy

Advanced metrics play a pivotal role in shaping investment strategies by providing investors with nuanced insights beyond traditional financial ratios.

These metrics enhance risk assessment capabilities, enabling a more comprehensive understanding of potential pitfalls and rewards.

Furthermore, they facilitate informed investment diversification, allowing portfolios to be optimized for both stability and growth.

Such strategic applications empower investors to navigate complex market environments with greater confidence.

Practical Applications of Financial Metrics in Market Analysis

Utilizing financial metrics effectively can significantly enhance market analysis by providing critical data points that inform decision-making processes.

Through comparative analysis, analysts can evaluate different investments and market conditions, revealing trends and opportunities.

Proper metric interpretation facilitates a deeper understanding of underlying factors, empowering stakeholders to make informed choices and strategically navigate the complexities of the financial landscape with confidence and autonomy.

Conclusion

In the realm of investing, understanding advanced financial metrics is akin to knowing the terrain before embarking on a journey; “forewarned is forearmed.” By leveraging codes like 512190676 and 294755577, investors can uncover deeper insights that drive strategic decision-making. These metrics not only enhance portfolio optimization but also equip stakeholders with the knowledge necessary to navigate market complexities. Ultimately, a thorough grasp of these indicators fosters informed investment choices, paving the way for financial autonomy and growth.